Collection: Schools and Universities

Empower your students for life. Make financial education a practical part of your curriculum.

Schools and universities play a crucial role in delivering financial education, acting as foundational platforms to provide students with the skills necessary for lifelong financial well-being.

What Makes Financial Education Worth Your Effort

Early Intervention and Habit Formation

Introducing primary children to basic financial concepts such as saving, budgeting, and responsible spending. Starting this education early (ages 5–12) helps normalise financial discussions and builds good habits before unhealthy ones take root. Through curriculum integration (math, social studies), schools can seamlessly incorporate real-life financial scenarios, enhancing relevance and retention.

Building Financial Capability During Transition Stages

Secondary schools can prepare students for the immediate financial responsibilities experienced by school leavers, like managing a limited allowance, part-time earnings, or savings accounts.

Universities also have a critical role as many students face independent financial decision-making for the first time (e.g., student loans, credit cards, living expenses). This period is crucial for teaching long-term financial planning, debt management, and investment basics, as well as building confidence and sound decision-making.

Reducing Inequality and Promoting Social Mobility

More than an academic focus, educational institutions help close financial literacy gaps for underprivileged, female, and minority students who may not receive this guidance at home. This contributes directly to reducing poverty and enabling upward mobility.

Developing Informed, Responsible Citizens

Financially literate students grow into adults who make informed economic decisions, avoid predatory practices, and contribute positively to the economy and society.

Schools and universities foster critical thinking and ethical decision-making in finance, linking personal choices with broader economic and social outcomes.

Partnerships and Community Integration

Through the Wealth Angels ecosystem, educational institutions can collaborate with local authorities, non-profits, and financial experts to deliver engaging, applied learning through workshops, simulations, and mentorship.

Embedding financial education into after-school programs and parent-child modules extends its reach beyond the classroom.

-

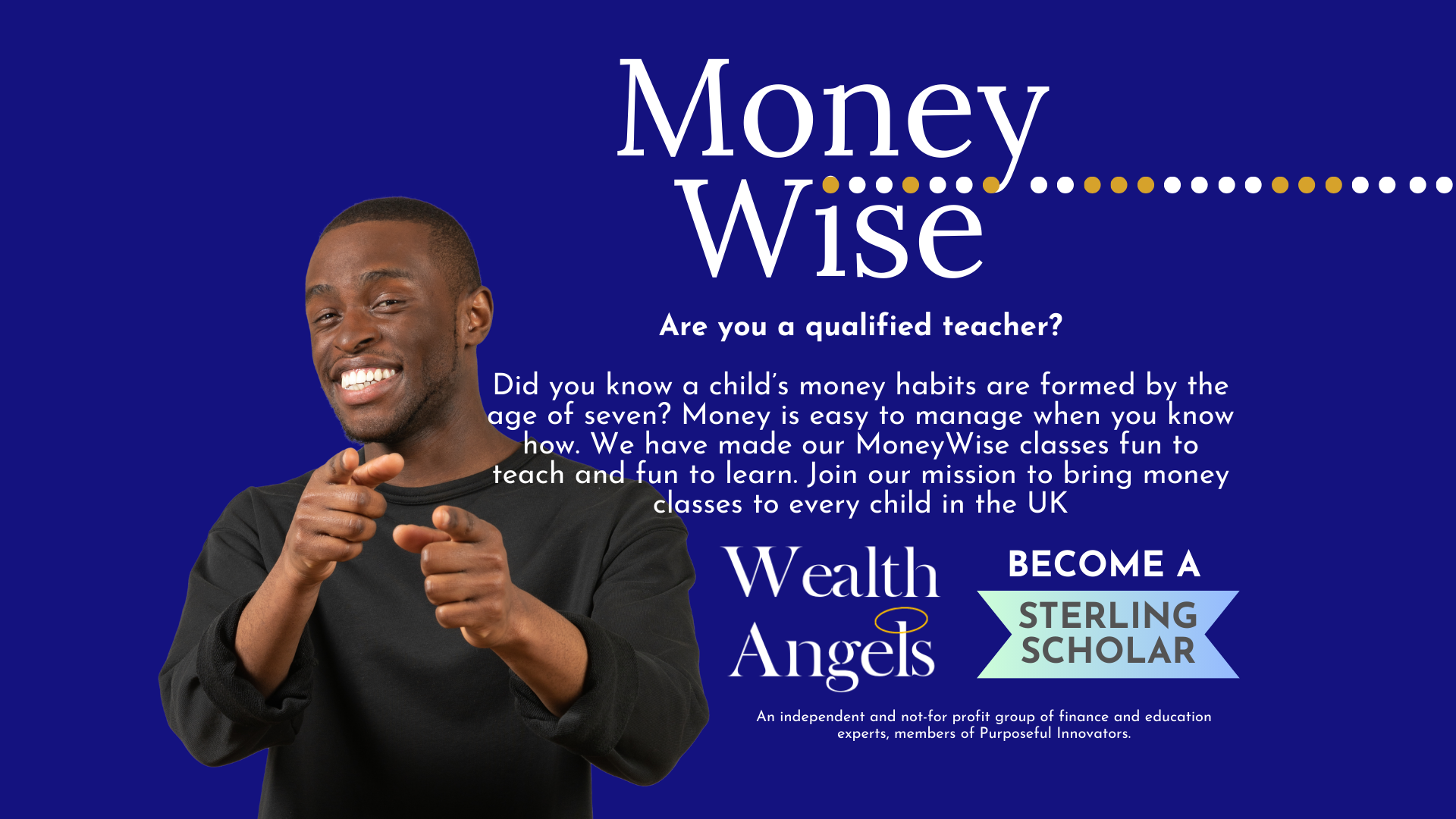

Wealth Angels MoneyWise Schools Programme

Vendor:Wealth AngelsRegular price From $63.00Regular priceUnit price / per -

Empowerment Through Financial Literacy - In School or Online for Parents

Vendor:Wealth AngelsRegular price $70.00Regular priceUnit price / per

Wealth Angels MoneyWise Testimonials

Wealth Angels MoneyWise Testimonials

"My daughter trialed a financial awareness course which is designed at helping children learn about money and which will give them a sounder foundation for making smarter monetary choices going forward in their life." - Z.C., London

"From a parents perspective we found the course content very comprehensive, well structured and well presented. It also seemed accessible to people from all walks of life and of different ages." - Y.C., Dubai

"We loved how the online classes get the whole family involved!" R.E. Dubai

"Our daughter really enjoyed the course and found the content interesting and engaging. She particularly liked role playing tasks that helped her come to grips with real-life scenarios in which she would have to make financial decisions." Anon, Dubai

"Our 6 year old keeps asked when the next money class will be, she really enjoys the activities and role play." R.L., London